October 4, 2017

Venture Capital

Five Reasons Why Your Startup Needs Funding.

A great idea and a strong will to succeed are just not enough in today’s generation. If you’re an entrepreneur who’s looking to grow and scale, you might want to look into funding your startup business.

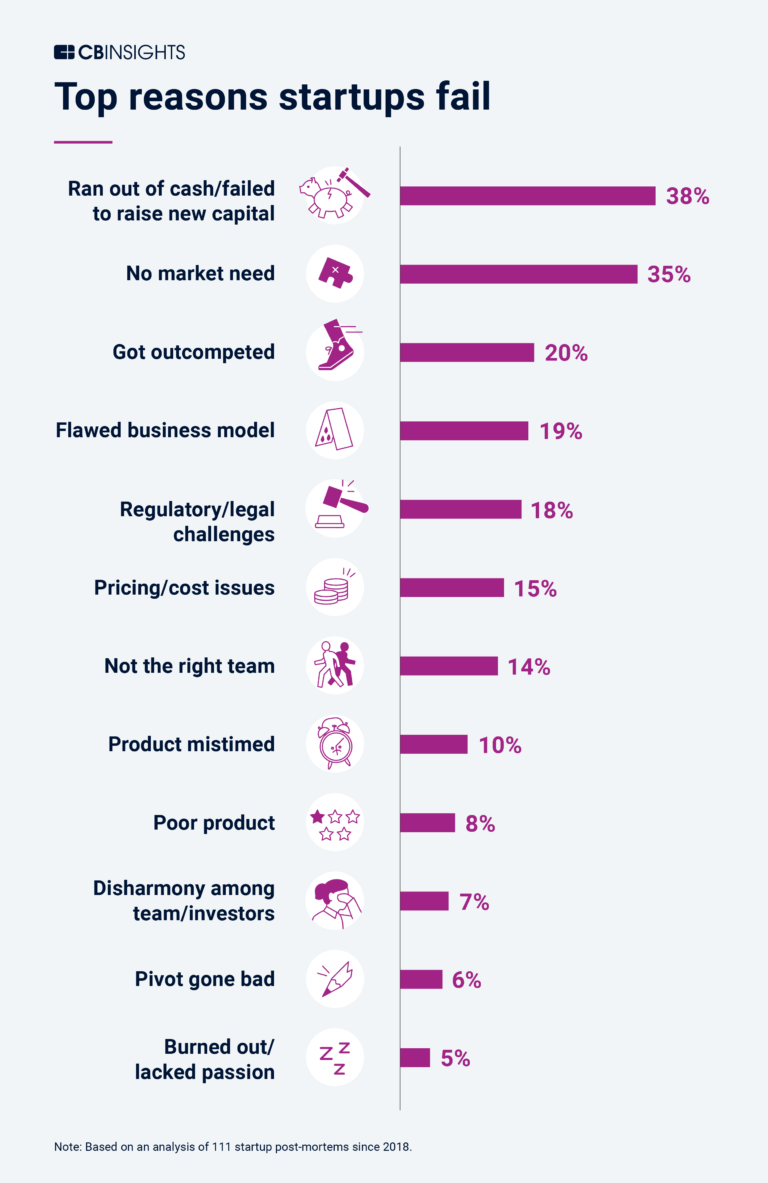

Surveys show that a lack of capital is one of the most common reasons why small businesses fail.

On the other hand, Apple, Google, and Amazon all started as small startups and grew into business giants thanks to funding.

Getting money for further business development is not “a piece of cake”. As a software development partner, we understand the difficulties. However, companies today that are in the startup phase have numerous options to get the funding they need. Venture capital, angel investing, or crowdfunding as some of the relatively new opportunities. The help is also available through startup accelerator programs.

Today, the saying “time is money” is more a reality than ever, especially in the technology sector. An entrepreneur with an idea usually needs funding to move on in no time.

So, if you’re an entrepreneur who’s taking your startup business seriously, here are five main reasons why you should get funding:

Build your startup idea on a solid base

Developing the initial idea into a solid product often requires more money and a bigger team. It means that to make your idea alive, you’ll need to hire more employees, attract specialists in the field, invest in production costs, and keep the operations running steadily in the development phase.

Capture as much of the market in as little time as possible

When you have a breakthrough idea that is well perceived in the market, you’ll probably want to capture as much of the market as possible. To compete in the market with other dominant players, you’ll need to increase your marketing and sales efforts. This, again, can only be done on a pretty penny. However, software outsourcing can help you accelerate your efforts.

Get additional value from your investors

The first reason to contact investors is, of course, to get funding. But investors can offer more than just money. They can help you get deals with other companies with which they have connections. After all, your success in the market is in their interest as well.

Attract the attention of the market and the future investors by having business funding

If your startup is getting funding from venture capital, or another business form, signalizes that you’re positioned for the future. Funding increases your visibility and attracts the attention of the market. It adds value to your business and shows to prospective partners and customers, as well as to future investors that you are worth considering.

When you’re bigger, you can do more

Some entrepreneurs prefer having a small company that they fully own. However, if you are among those who aim for more, you need more money – to attract top talent professionals for further development of the company, to conquer the market with cutting-edge products, and to build a respectful position among other players in the field. Learn more about how our outsourced development team can help. After all, wouldn’t you rather own 1% of a billion-dollar company than own 100% of a company worth nothing at all?

Positive trends in startup business funding

The funding climate is great for the innovation sector, as shown in the U.S. Startup Outlook 2017, issued by Silicon Valley Bank.

Generally speaking, the trend is definitely positive: the survey points out that investors are doing deals, more funding options are available, and the exit market has improved.

According to the survey, venture capital is the most important source of capital: 51% of startups said that their most likely next source of funds was venture capital.

This is a good way of thinking since the Crunchbase report about the state of the global venture capital ecosystem in Q2 2017 shows that the market for startup equity is on a firmer footing than three months before.

According to the report, there has been growth in deal and dollar volume at almost all stages, rounds were growing in size, and some of the most active venture capitals have doubled their investing activities.

However, the entrepreneurs who participated in the Silicon Valley Bank Startup Outlook Survey found that fundraising became more difficult for startups: 88% of participants found the current fundraising environment extremely or somewhat challenging.

But don’t give up! Just keep on doing a great job!

Did you know that Pixar heard ”no” 45 times before Apple invested in this company, which today is the owner of the 12 animated films listed among the 50 highest-grossing animated films of all time?